Tubacex continues to advance in the execution of strategic contracts centered on premium products, while maintaining an order backlog at historic levels, reinforcing visibility for the remainder of the fiscal year

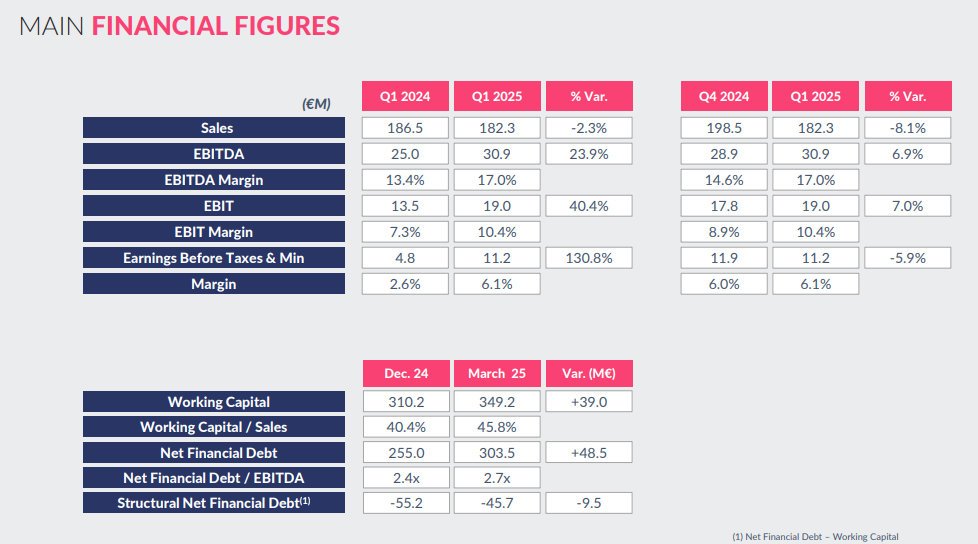

- Tubacex reports an EBITDA of €30.9 million, up 23.9% compared to Q1 2024, and a pre-tax profit of €11.2 million, representing a 130.8% increase year-on-year.

- The company achieves an EBITDA margin of 17%, the highest quarterly margin in the Group’s history and well above the strategic target set in the NT² 2027 Plan.

- The order backlog stands at €1.5 billion, with a premium profile, high added value, and multisectoral composition.

- 2025 is expected to be a year of gradual improvement, with results accelerating in the second half, driven by the invoicing and deliveries of contracts with ADNOC and Petrobras.

- The current tariff environment has a limited direct impact on Tubacex, thanks to its strong competitive position in the U.S. market, where it operates seven plants and follows a project-based, end-customer sales strategy.

- Tubacex continuously monitors the current period of international uncertainty — which also presents potential future opportunities — reaffirming its strong commitment to achieving the objectives set out in the NT² Strategic Plan.

Bilbao, April 25, 2025 – Tubacex Group closed the first quarter of 2025 in line with the targets set for the year. Sales for the period reached €182.3 million (-2.3% vs. Q1 2024), with an EBITDA of €30.9 million (+23.9%) and a pre-tax profit before minority interests of €11.2 million (+130.8%). The most significant figure of the period is the EBITDA margin, which rose to 17% — a record high for the Group — driven by a consistent strategy focused on high value-added products, long-term contracts, and sectoral diversification, in line with the NT² 2027 Plan. This achievement is particularly notable given that billing from major contracts — including the one signed with ADNOC, already under production, has not yet been recognized in revenue and will be reflected starting in Q2.

In this context, the licensing agreement of the Sentinel® Prime connection technology with ADNOC represents a strategic milestone of global scope, positioning it as the premium reference solution for carbon steel OCTG developments in Abu Dhabi. The agreement reinforces the industrial collaboration between the two companies and further consolidates Tubacex’s strategic positioning in the Middle East alongside a key partner.

The company’s backlog remains at €1.5 billion, with a strong focus on complex solutions for critical sectors such as Oil & Gas, Industrial, PowerGen, CCUS, and Aerospace. This base ensures revenue visibility for upcoming quarters and supports a rebound in activity in H2, when the bulk of the ADNOC and Petrobras contracts will be invoiced. Tubacex’s positioning with strategic customers and its commitment to long-term agreements are key to sustaining a high backlog of strategic, high value-added products.

As stated by the company: “The results presented today confirm our ability to deliver high margins consistently over time. In the second half of the year, the start of production of large-scale projects is expected to gradually boost our financials. The agreement with ADNOC further strengthens our unique technological and strategic positioning in the Middle East. We remain committed to long-term value creation and to meeting the objectives of our NT² 2027 Plan.”

Market development and multisector positioning

By sector, 30% of Q1 revenue came from the E&P Gas segment, followed by 28% from Industrial, 20% from New Markets (including aerospace, defense, fertilizers, and instrumentation), 17% from E&P Oil, and the remaining 5% from PowerGen. This breakdown underscores the Group’s strategic diversification, both in terms of sectors and technology.

Geographically, Asia and the Middle East accounted for 47% of sales, Europe 26%, the Americas 24%, and Africa 3%. This global footprint reflects the company’s selective internationalization strategy, focused on regions with significant investments in energy, energy transition, and process industries. In the Low Carbon segment, Tubacex secured its first carbon capture project in bioenergy in Brazil, utilizing Sentinel® Prime premium CRA OCTG connections. The expansion of Tubacoat coating technology also continues, with new applications in the petrochemical sector, alongside developments in low-carbon hydrogen and electrolyzer solutions. In PowerGen, new nuclear projects in Europe and Ultra Super Critical (USC) boiler initiatives in India stand out, where the company has installed a new shot peening line. In Industrial, strong demand continues for heat exchangers and chemical process piping in Asia and Europe. In New Markets, growth continues in aerospace, defense, and semiconductors, while in hydraulics & instrumentation, Tubacex has increased market share in Asia-Pacific thanks to capacity expansion and increased competitiveness at its Indian plant.

Financial strength and focus on cash generation

During the quarter, Tubacex’s Net Financial Debt stood at €303.5 million, with a net debt/EBITDA ratio of 2.7x — slightly above the NT² Plan target (<2x) — due to the increase in working capital from the early manufacturing of orders that will begin to be invoiced in Q2 2025. Cash amounted to €167 million, and the equity-to-assets ratio remained strong at 35%.

Tubacex reiterates its deleveraging objective for the second half of the year, as ongoing industrial investments are monetized, and billing of large-scale contracts intensifies.

The Group continues its disciplined investment policy, with a total CAPEX of €20.3 million in the quarter.

2025: A year of growing results

Looking ahead to the full year 2025, Tubacex maintains a positive outlook, anticipating a favorable performance in the second half in terms of revenue, EBITDA, and cash generation.

Finally, the strategic objectives outlined in the NT² 2027 Plan are reaffirmed, which include:

- Sales: €1.2–1.4 billion.

- EBITDA: Over €200 million.

- Net Debt/EBITDA: <2x.

- Pay-out: 30–40%.

ESG Commitment and Sustainability

Tubacex continues to make progress toward its 2030 climate and social targets. Its key ESG indicators show positive momentum toward its decarbonization, circularity and equity commitments, validated by leading international organizations such as CDP, SBTi, and S&P Global.