• Order intake increased by 30%, compared to the previous year.

• The gradual and general market recovery is enabling operating leverage ratios to be maintained for all business units and therefore, achieving double-digit consolidated margins.

• In 2019, sales amounted to €613.5 million thanks to market improvement and the incorporation of the NTS Group.

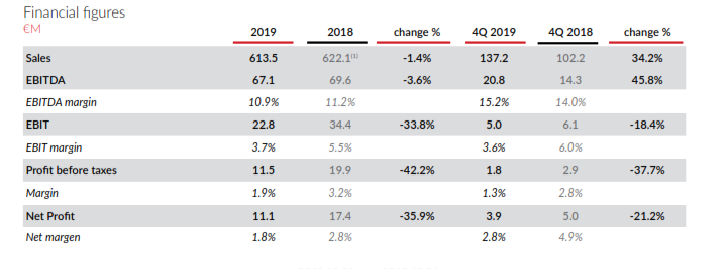

• Profit ended the year at €11.1 million and a dividend distribution of €6 million has been proposed (€0,046 per share).

• Thanks to the effort we have made in recent years, TUBACEX is now better prepared to face a change in trend on the market.

• TUBACEX anticipates 2020 will bring an upward trend in result generation thanks to a gradual market improvement.

Llodio, February 28, 2020. 2019 has marked a turning point for recovery as TUBACEX order intake demonstrates. Although far from pre-crisis levels it has experienced an increase of 30% in relation to the previous year. This gradual and general market recovery is also enabling operating leverage ratios to be maintained for all business units and therefore, achieving double-digit consolidated margins. Also, 2019 turnover amounted to €613.5 million, in line with sales of the previous year, thanks to market improvement as well as to the incorporation of the NTS Group. EBITDA closed the year at €67.1 million, only 3.5% below 2018 EBITDA, and with a margin of 10.9% and a profit of €11.1 million.

According to Jesus Esmoris, CEO of TUBACEX, “in spite of the long crisis, TUBACEX has never stopped its strategic investments through all these years, but has made progress towards our positioning as a key supplier of tubular solutions to end users. New products and services have been developed, companies have been acquired to extend the Group’s value offer, a new plant has been built in the United States, and alliances have been forged with very important strategic partners.”

Thanks to the effort we have made in recent years, TUBACEX is now better prepared to face a change in trend on the market. This recovery is expected to continue in 2020 and in addition to this, several major projects are now in their final award and negotiation phases.

The working capital amounted to €187.2 million in December, €35 million under the close at 2018 and with a percentage over sales of 30.5%, which comfortably meets the strategic goal of maintaining this target under 35%.

Moreover, the net financial debt amounted to €253.6 million, reaching 3.8x EBITDA. According to TUBACEX business model, where products are made to order, the financial debt is closely related to the working capital, which is mostly sold at a net positive realization value. The working capital represents 73.8% of the debt, so the company’s structural financial debt without including the working capital stands at €66.3 million. The Group debt increase during 2019 is mainly based on extra investments made. In addition to acquiring the minority stake which did not hold in IBF and the takeover of NTS Group which represented expenses of almost €30 million, Tubacex Group has built a new plant in Durant (Oklahoma, USA) which was commissioned in December and is expected to be fully operational in the second semester 2020.

These three operations together with normal investments from the Group have resulted in an exceptional increase in the total CAPEX for the year exceeding €60 million.

TUBACEX has maintained a similar net financial debt compared to 2018 in spite of those extraordinary investments, which demonstrates our capacity for cash flow generation throughout the year.

Moreover, as it has become customary regarding the Group’s financial strategy, its solid financial structure should once again be emphasized, with a high cash position in excess of €150 million which will enable it to face debt maturities in the next 4-5 years. Our debt ratio is expected to meet the Group x3 strategic objective at the 2020 year-end.

Regarding future prospects, TUBACEX anticipates 2020 will bring an upward trend in result generation thanks to a gradual market improvement. This improvement, along with the award of important orders that is expected in the short term, would lead to a year-end with a record intake figure and much visibility for the forthcoming years. As Esmoris explained, “with due caution in the face of external factors, such as the coronavirus, we can now say we have turned the corner on the worst crisis in the sector and we now enter into a period of major growth for our Company”.

TUBACEX by market

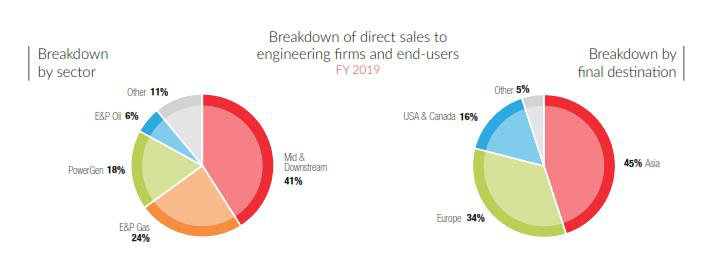

Turnover through the distribution channel has continued with its positive trend which began in 2018 thanks to the development of TSS (Tubacex Service Solutions) and the growth of our stocks in Asia.

The Oil&Gas Extraction and Production sector accounts for 30% of the sales, with 24% corresponding to Gas and 6% to Oil. The sector is experiencing an increase in terms of the activation of important projects, mainly in the Middle East. Once the design phases of large projects are completed, the purchase phase is about to start with the launching of different public tenders for award in the short term. This is even more obvious in relation to gas production driven by reduction targets for polluting and CO2 emissions. The Subsea, Umbilicals, Risers and Flowlines (SURF) segment, where order intake has reached historical record figures for the Group, also deserves special mention.

In 2019 the Power Generation sector improved its performance compared to 2018, both in the thermal and fossil fuel power generation as well as the nuclear power segments. In the conventional power generation segment, the demand for advanced steels and treatments such as shotpeening for supercritical technology plants has grown in countries like China and India, and a significant rise is also expected in South Korea in forthcoming years. Regarding the nuclear market, despite the recent uncertainty that has characterized this sector, our turnover has followed a growing and highly profitable trend.

The Mid and Downstream sector also recorded high activity throughout the year, with a growing trend in geographical areas such as the United States and China. The good performance of tubes for furnaces and large-diameter tubes for refineries, a sector where TUBACEX is consolidating our strategy to become a comprehensive supplier of tubular solutions, with a greater range of products and new added services on offer, was also outstanding. The ceramic solution supplied by Tubacoat which is beginning to play a major role in direct sales to refineries is also worth special mention.

Likewise, it is also worth highlighting we are entering new sectors which represents a strategic commitment for TUBACEX. One of those sectors is Fertilizers, where the Group has maintained a strong technical and positioning effort thanks to the development of all the formats needed to supply the entire portfolio for urea plant construction. Another sector gaining momentum is the Precision tubes for transportation market. In 2019, it is worth mentioning the excellent performance signed by the aeronautical segment with a significant rise in sales in the United States, where the Group is installing a new plant in Oklahoma to reinforce its position even further.

Key Financial Figures 2019