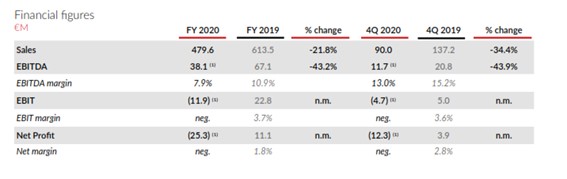

- TUBACEX ended the financial year with sales of 479.6 million euros, 21.8% less than the previous year and with EBITDA OF 38.1 million euros. Accumulated losses reached 25.3 million euros and derive mainly from negative results at the Basque production plants.

- The severe structural crisis affecting the sector, compounded by the pandemic, is accelerating the transition cleaner sources of energy, forcing the company to implement far-reaching financial, organizational and commercial measures.

- The company’s ability to resist the effects of the crisis is due to the effective and agile implementation of these measures.

- Workforce restructuring in the Group, which will finally affect 600 people, is at an advanced stage, pending only implementation in the Basque production plants.

Llodio, February 26, 2021. Today TUBACEX presented results for the 2020 financial year to the CNMV which, like the rest of the sector, are well below initial expectations. Without coming close to levels registered before the ongoing, sector-specific crisis, there were signs of a slight recovery at the beginning of last year. However, the pandemic caused by COVID-19 then resulted in an unprecedented global recession. Against this backdrop, TUBACEX’s sales reached 479.6 million euros, 21.8% less than the previous year, with EBITDA of 23.81 million euros, 43.2% lower than in 2019. The end-of-year results amounted to losses of 25.3 million euros, concentrated mainly in the Basque production plants.

These results for the TUBACEX Group also include extraordinary adjustments to a value of 20.3 million euros, all completed without affecting the cash position, and aimed at securing the company’s balance sheet and preparing for the eventual market recovery.

As is already known, TUBACEX has been forced to take some difficult decisions, adapting not only to the exceptional events of 2020, but to the crisis resulting from underlying changes in the sector. These decisions include “the need to reduce the global workforce by around 20% – 600 people by current calculations – to guarantee the continued viability of the Group. The restructuring is already at an advanced stage, pending only changes in the Spanish production plants” explains TUBACEX CEO Jesús Esmorís. The process forms part of a Group-wide cost-cutting exercise, bringing recurrent annual savings of more than 30 million euros over a base of fixed costs. The measures are also part of a crisis management plan which incorporates actions to strengthen the financial structure of the Group and increased efforts from sales teams.

More specifically, the successful financial restructuring involved diversifying lenders and obtaining significant extensions on debt maturity. “We end the year with a liquidity position, between cash position and available assets, of more than 240 million euros, contributing to greater solvency for the Group in the short and mid-term, and allowing us to meet financial obligations on debt until well into 2024” indicates Jesús Esmorís, TUBACEX’s CEO.

Finally, and despite the current adverse market climate, the sales team has focused efforts on pursuing multiyear contracts with the end-users of those TUBACEX products with the highest added value, thus paving the way for the Group’s future growth.

Thanks to this crisis management plan, implemented over recent months, the Group is better positioned to tackle the current adverse situation.

A key player in the energy transition

Just as the company has been indicating for some years now, the continued decline of the Oil and Gas sector from 2014 onwards, combined with an excess in installed capacity for the production of its products, has forced TUBACEX to rapidly diversify and redirect activities. This change in focus has featured in the Group’s strategic plans for the last six years. Moreover, the pandemic has caused an underlying change in society, not just at a personal level, but through increased sensitivity to environmental issues, which will have a significant impact on the future of the business. The energy transition, towards cleaner sources of energy and more sustainable development, is an unstoppable trend. A clear sign of this are the vast amounts global customers have started to invest in clean energies (REPSOL, TOTAL, BP etc.)

As part of their diversification strategy, TUBACEX is already working on the development of solutions for clean energy sectors, such as the transport and storage of hydrogen and renewable energy, as well as other sectors not linked to energy, such as transport and aerospace, among others.

To that effect, TUBACEX has defined a series of work streams focused on; optimizing internal processes to minimize environmental impact, developing advanced solutions aimed at increasing efficiency and reducing CO2 emissions, and increasing participation in cleaner industries and applications.

Key Financial Figures 2020

About TUBACEX

TUBACEX is a multinational group with its headquarters in Alava and a global leader in the manufacture of stainless steel and high-alloyed tubular products (tubes and accessories). It also offers a wide range of services from the design of tailored solutions to installation and maintenance operations.

It has production plants in Spain, Austria, Italy, the United States, India and Thailand, as well as Saudi Arabia, Dubai Norway, Canada and Singapore through the NTS Group, worldwide service centers and sales offices in 38 countries.

The main demand segments for the tubes manufactured by TUBACEX are the oil and gas, petrochemical, chemical and power generation industries.

TUBACEX has been listed on the Spanish Stock Market since 1970 and is part of the “IBEX SMALL CAPS” Index. www.TUBACEX.com