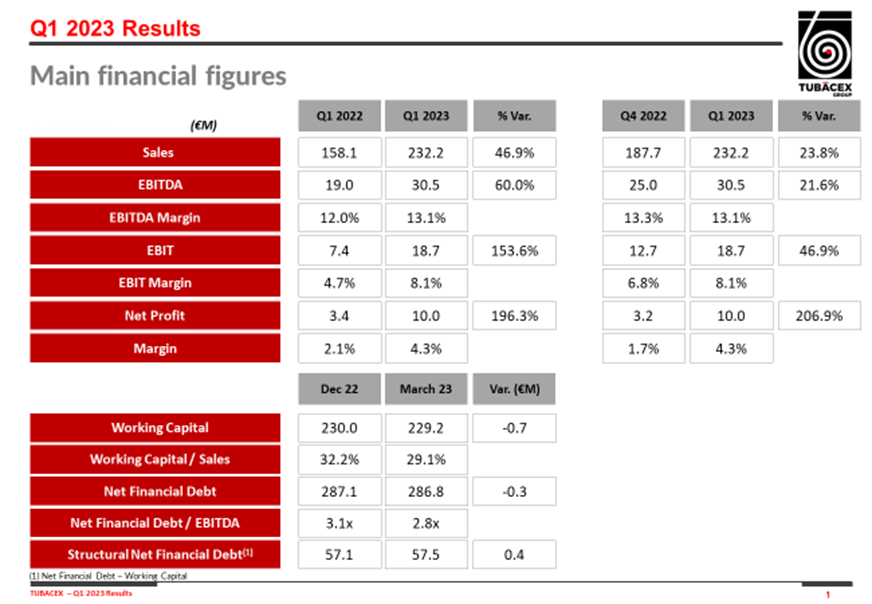

- Sales for the first quarter have reached €232.2 million, a 46.9% increase from the same period last year.The EBITDA margin stands at 13.3% and reaches €30.5M, a 60% increase compared to the first quarter of 2022, representing the highest figure ever achieved.

- The order book remains at €1.65 billion, providing great visibility for 2023 and anticipating a year of clear growth, in line with the current Strategic Plan.All business units and production plants within the Group are profitable, including those located in Spain.

- Tubacex’s growth in all market segments it operates in provides resilience and visibility to the Group, with a diversified portfolio of premium products and services. The company’s performance in projects related to low-carbon technologies, particularly in the field of carbon capture, utilization, and storage, is noteworthy.

Derio, April 21, 2023. Tubacex has today presented to the CNMV the results for the first quarter of 2023, in which it has achieved its best quarterly sales figure in its history.

The company has achieved its highest quarterly sales figure in history, thanks to increased volumes sold and an improved product mix. This growth in sales has occurred in a market that continues to perform strongly in terms of performance and contracting.

Tubacex’s sales reached €232.2 million, an increase of 46.9% compared to the same period last year, with a profit of €10.0 million. The company also achieved its highest quarterly net EBITDA in history, amounting to €30.5 million, representing a margin of 13.1%, which is a 60% increase compared to Q1 2022.

Despite a bullish sales environment, the company has maintained its historically high order backlog of €1.65 billion, with record order intake in the first quarter. These record results are attributable to its product mix and cost-cutting efforts over the past few years, which have helped to offset the current inflationary environment and achieve profitability in all its plants.

Jesús Esmorís, the CEO of Tubacex, expresses that “the beginning of 2023, driven by a dynamic energy market with significant investment and visibility, confirms the company’s predictions, reinforcing our position as a multi-energy player in the current energy transition scenario.

Part of the cash generated during the quarter has been allocated to the acquisition of minority stakes in Saudi Arabia and Norway and to the commencement of investments in the new Abu Dhabi plant (totaling €8.5 million). Net financial debt thus remains at a level like that of the end of 2022 (with a slight reduction of €0.7 million), and the net financial debt to EBITDA ratio is reduced to 2.8x, anticipating the company’s strategic target for 2025. Tubacex continues to strengthen its financial solidity, with a liquidity position of €219.7 million. It should be noted that Tubacex’s make-to-order manufacturing strategy means that net financial debt is closely linked to the working capital that has mostly already been sold, hence the importance of inventory being higher than net financial debt.

Committed to promoting sustainability and energy transition

Tubacex´s sustainability policy positions the company as a leader in its sector. It has recently been awarded with the A- sustainability rating from the renowned organization CDP (Carbon Disclosure Project), which places Tubacex among the best in class in its sector category.

Additionally, because of its purpose to support its customers and suppliers in decarbonization processes, Tubacex has recently been included in the list of supplier engagement leaders from CDP, which recognizes the results of its actions related to climate issues with regard to its supply chain.

In the field of energy transition, it is estimated that incentives in the United States will trigger numerous projects for the capture, use, and storage of CO2 (CCS), in which Tubacex is a pioneer in its sector. Likewise, similar regulatory measures are being adopted in the United Kingdom, Australasia, and the Middle East, which further bolster the company’s position in the low-carbon emissions technology segment, including outstanding growth in CCS projects, hydrogen developments, and biomass energy recovery projects.

Diversified segment focus, global operation, and proximity to its customers

According to Tubacex’s product distribution, 44% of their products were allocated to the industrial sector, 32% to the oil & gas sector, 17% to new markets, and 7% to Powergen.

Its sales destinations are geographically diverse, with 36% of sales in Asia and the Middle East, 31% in the Americas, 29% in Europe, and the remaining 4% in Africa. Tubacex operates 22 factories in 14 countries and 12 service centers to meet the demands of its customers.

On the other hand, Tubacex has seen a strong demand growth in new markets such as aerospace, defense, and the H&I (hydraulic and instrumentation) segment. One of the most significant recent achievements has been the awarding of a major contract by the Norwegian energy operator Aker Solutions to Tubacex for a relevant supply of umbilical tubes, totaling 1,000 kilometers in length in this application. This operation is one of the most significant awarded in the umbilical sector, with a total value of 70 million euros for the company. This strategic installation on the Norwegian continental shelf opens the possibility of obtaining new projects in the future in a highly technological sector.

Meanwhile the OCTG sector continues to receive investments from major operators mainly in the Middle East, Brazil, and the Caribbean. In Brazil, Tubacex has begun operations to install its complete OCTG-CRA equipment solution in the Buzios field. In Abu Dhabi, Tubacex is making good progress in the installation process of the OCTG-CRA plant, which will be implemented in partnership with the company ADNOC. The company plans to start operations by the end of 2024 and operate at full capacity from 2025.

In the industrial sector, there has been a resurgence of investments in the Middle East and the US, as well as in several petrochemical projects in China. Additionally, the Caspian Sea area, particularly in Kazakhstan, where Tubacex maintains a high level of contracting, deserves special mention.

Regarding the power generation segment, Tubacex is focused on promoting circular economy technologies and transitioning away from conventional coal projects. The nuclear segment remains dynamic, with good prospects for the coming years. Tubacex enjoys a good positioning with EDF as a long-term strategic partner for maintenance and safety projects in its nuclear power plants, with new contract prospects on the horizon.

The nuclear segment, on the other hand, shows signs of dynamism and has promising prospects for the coming years. Tubacex has a strong position as a long-term strategic partner for EDF in maintenance and security projects in their nuclear power plants, and there are new prospects for awards in the near future.

Innovation and people, keys to the future

One of the highlights of the first quarter of 2023 was the delivery of the Energy Intelligence Center building to the company, a technological research center of reference for the development of new materials, products, and solutions applicable to new technologies that advance decarbonization in the energy, industrial, and mobility sectors, such as green hydrogen or carbon capture, among others. These facilities, which will house the company’s innovation teams, will have a full-scale laboratory where Tubacex will carry out real-scale tests of its innovative applications in this field. This is a key initiative in Tubacex’s innovation strategy for the coming years.

Main financial figures

About Tubacex

Tubacex is a global leader in the design, manufacturing, and installation of sophisticated industrial products and high value-added services for the energy and mobility sectors. Tubacex brings value to its customers through its global presence, with production plants and service centers in Spain, Austria, Italy, United States, India, Thailand, Saudi Arabia, Dubai, Norway, Canada, Brazil, Singapore, Guyana, and Kazakhstan. Its sustainability and environmental policies are endorsed by leading ESG certification organizations, such as Science Based Targets (SBT) emissions reduction commitments, CDP (Rating A-) accreditation, and sustainability standards from S&P and Ecovadis, among others. Tubacex has been listed on the Spanish stock exchange since 1970 as part of the Ibex Small Caps Index.