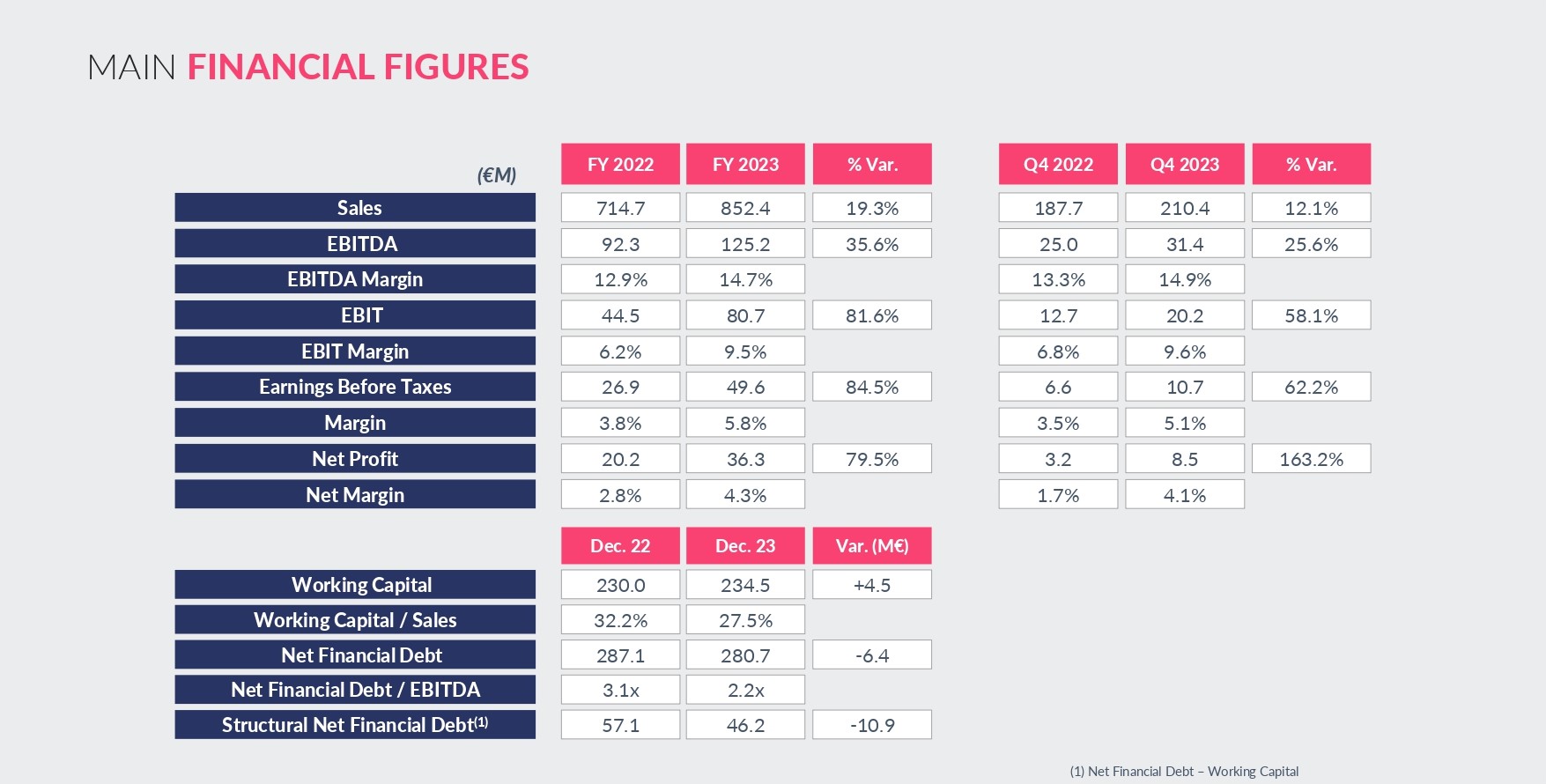

- The Group’s sales rose to €852.4 million, a 19.3% increase from the year 2022.

- EBITDA reached €125.2 million, a 35.6% increase from the previous year, with an EBITDA margin of 14.7%, the highest in the company’s history. These results underscore the strategic milestones anticipated for 2025 and mark the launch of the new Strategic Plan, NT2.

- The order book stands at a record €1.6 billion, thanks to a business model that emphasizes premium, multi-sector solutions, showcasing significant demand growth in the low carbon sector.

- Tubacex’s net profit soared to €36.3 million, a 79.5% increase from the previous year, reflecting the company’s resilience and adaptability in a challenging macroeconomic and geopolitical landscape.

- Amid a challenging macroeconomic and geopolitical environment, the results achieved, along with the addition of new contracts during the year (maintaining a contracting to sales ratio close to 1), represent the early achievement of the strategic goals set for 2025, as well as the commencement of the new Strategic Plan, NT2.

- Throughout 2023, all units of the Group have consolidated structural cost reductions and are oriented towards added value, not production volume.

- The company ends the year with liquidity above €300 million and a decreasing debt level, with a Net Financial Debt/EBITDA ratio of 2.2 times, improving from previous measurements and reinforcing its strategic objectives.

- The Board of Directors has proposed a gross dividend of €14.5 million, representing a payout ratio of 40%, reflecting the company’s solid financial health and commitment to shareholder returns.

Bilbao, February 29, 2024.

TUBACEX has achieved a net profit of €36.3 million for 2023, marking a 79.5% increase from the previous year and continuing the strong momentum seen in prior periods. With consolidated sales reaching €852.4 million, the company has experienced a 19.3% growth compared to 2022, setting a new sales record. Despite downward trends in raw material prices, strategic long-term agreements with its customers´ and an optimal product mix have driven significant sales and profitability increases. The firm has achieved significant progress in the Gas Upstream sector and within key markets in Asia and the Middle East, in line with its strategic goals. The cultivation of strategic partnerships and the securing of long-term contracts have been instrumental in solidifying the company’s targeted profit margins.

The year-end EBITDA of €125.2 million, up 35.6% from 2022, and an EBITDA margin of 14.7%, represent the highest figures in Tubacex’s history, with a peak EBITDA margin of 14.9% in the last quarter.

Achieved against a backdrop of complex macroeconomic and geopolitical challenges, these favorable outcomes affirm the company’s strategic trajectory and bolster its pivotal role in facilitating the energy transition and ensuring the security of energy supply. With the early achievement of its 2025 strategic goals, Tubacex has initiated a new Strategic Plan.

Looking ahead to the upcoming fiscal year, expectations remain positive, leading to the anticipation of achieving the new strategic objectives unveiled last November at the Capital Markets Day for investors. In this context, the order intake continues to be robust (with the current book-to-bill ratio standing at 0.94, reflecting the company’s strong performance in a year of record-breaking revenue), positioning the order book at €1.6 billion and ensuring business visibility for future periods.

Jesús Esmorís, CEO of Tubacex, stated, “With today’s reported results, the Group concludes 2023 with unprecedented performance figures. Moreover, despite the challenges of a rather complex macro and geopolitical context, we expect the first half of 2024 to align with the previous year, with upside potential in the second half of the year and order intake levels that will allow us to anticipate growth in 2025.

Revenue breakdown by sector shows 35% from Industrial, 24% from Gas E&P, 19% from Oil E&P, 15% from new markets, and 7% from power generation.

Regarding the final destinations of its sales, there is a significant geographic diversification in its revenue sources, as 43% of sales have occurred in Asia and the Middle East (where it has significant exposure to the gas sector, both in extraction and processing), 33% in America (with an increasing importance of the H&I segment and a record number of orders in the aerospace sector), 21% in Europe (with strong demand for complex machined products in the North Sea, and long-term agreements with umbilical manufacturers) and the remaining 3% in Africa (with new offshore projects in Tanzania, Namibia, Mozambique, and South Africa).

Strengthening and Solidifying the Liquidity and Debt Position

Throughout the analyzed period, Tubacex has maintained a trend towards de-leveraging and strengthening its financial solidity. As a result, the debt ratio (Net Financial Debt/EBITDA) stands at 2.2 times as of the end of December, solidifying the achievement of strategic goals with the expectation of further reduction in future periods. Additionally, the Group boasts a liquidity position exceeding €300 million.

This is even though part of the cash generated during the year was allocated to the purchase of a minority stake in Saudi Arabia, the acquisition of a subsidiary in Norway, the commencement of investment in the Abu Dhabi plant, and the payment of dividends for the 2022 fiscal year. These operations, along with CAPEX, resulted in a cash outflow of €55 million. However, the Group’s strong cash generation capability has balanced the situation, resulting in a net financial debt of €280.7 million as of December 31, a figure that favorably compares to €287.1 million at the end of the previous year.

All the Group’s businesses are oriented towards added value

Delving into the details by Business Units, E&P Oil&Gas (upstream) remains strong in the period analyzed. The execution of operations in the deep waters of Brazil continues, and an ongoing increase in Petrobras operations is expected in the coming months with comprehensive solutions supplied from Tubacex’s base in Macaé, RJ. Also noteworthy is the progress in constructing a new OCTG-CRA plant in Abu Dhabi as part of the project signed with ADNOC.

For E&P Oil&Gas (subsea), the Group concludes 2023 with a record number of orders and key strategic projects across all five continents. Additionally, work continues strategic agreements with leading umbilical manufacturers, a dynamic that has been yielding excellent and structural results over time, allowing for further market share growth in this niche.

In the Industrial sector, the Mid&Downstream segment has seen a resurgence in the awarding of major projects, especially in the Middle East and Asia, in the last quarter of the year. Furthermore, the LNG and Gas Processing sectors maintain a high level of activity and visibility, particularly in North America and the Middle East.

In PowerGen, Tubacex is moving away from conventional coal projects and shifting towards a circular economy and energy transition. Thus, activities in the second half of the year have focused on the nuclear industry, especially in Europe, where the Group maintains dynamism and a strong position, with good prospects for the coming years. Similarly, Tubacex also has promising outlooks for future SMR reactors, especially in Canada, the United States, and Europe. In addition, the company continues with its projects for power generation plants using USC technology in China and India.

In the Low Carbon sector, there is significant dynamism in capturing orders for CO2 capture, use, and storage (CCUS) in the United States, supported by government incentives, and in other regions like Malaysia, where the first order in this segment for the Asian market was secured. The Tubacoat division also maintains a strong global position, with significant orders in the United States (Exxon, Marathon, Motiva, and BP) and the Middle East, enabling several projects in Saudi Arabia (SATORP and Jazan) for critical applications that contribute to energy efficiency and the reduction of CO2 emissions from refineries. The revenue target for this division is to reach €100 million by 2027.

Finally, in New Markets, there’s notable growth in demand from new sectors such as aerospace, both in commercial aviation and space exploration, as in the H&I segment (hydraulic and instrumentation), where Tubacex will supply H&I tubes for IOCL´s R&D facility in India. Moreover, in the last quarter, the company has formalized several high-value orders for the fertilizer industry.

NT2: Tubacex Unveils Forward-Looking Strategic Plan Targeting 2027 Objectives

After achieving most of its objectives set for 2025 two years ahead of schedule under the current Plan, Tubacex announced to the financial community last November its goal to achieve sales between €1.2 and €1.4 billion and an EBITDA of over €200 million by 2027. With this, the Group significantly accelerates its growth expectations for the next four years.

This will be achieved while maintaining financial solidity and a healthy balance sheet as before. In this regard, Tubacex will continue the trend towards financial deleveraging throughout the period, which, along with strengthening cash flow, is expected to bring the Net Financial Debt/EBITDA ratio below 2 times by the end of 2027 (compared to 2.2 times at the end of 2023). In doing so, the company will solidify the achievement of one of its strategic objectives, with the expectation that such leverage will decrease year by year, even as it undertakes various inorganic growth operations.

In this context, and with the growth expectations already mentioned at the results level, Tubacex will also maintain an attractive shareholder remuneration policy. In this respect, the Board of Directors has proposed the distribution of a gross dividend of €14.5M, representing a payout of 40%.

About Tubacex

Tubacex is a global leader in the design, manufacture, and installation of advanced industrial products and high-value-added services for the energy and mobility sectors. Committed to innovation and excellence, its fully integrated production model spans from research and development to final product delivery and maintenance services. This integration ensures cutting-edge technology, superior quality, and a focus on sustainability and circularity. Specializing in corrosion-resistant alloy materials and advanced machining services, Tubacex operates production facilities and service centers in over 30 countries, delivering value worldwide. Its commitment to sustainability and environmental management is recognized by leading ESG certification authorities, including adherence to Science-Based Targets (SBT) for emission reduction, the Carbon Disclosure Project (CDP), and compliance with S&P’s sustainability criteria.