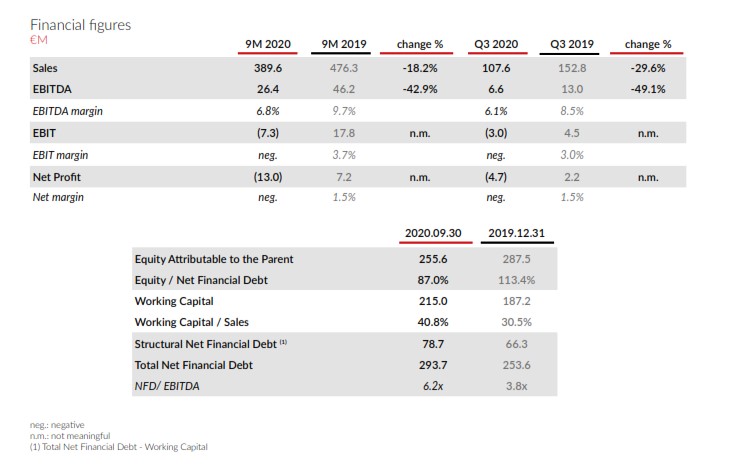

- TUBACEX’s sales figure for the first nine months of the year amounts to €389.6 million, which is 18.2% lower than that of the same period last year; while EBITDA stands at €26.4 million, down 42.9%, with a 6.8% margin.

- These results, determined by the global macroeconomic and health care environment, and as with results for the first half, are well below the Group’s expectations at the start of the year.

- TUBACEX`s high financial solvency guarantees the company’s liquidity in the short and medium terms.

- The Company has launched an Action Plan based on three work lines: cost adaptability, financial strengthening, and signing relevant multi-annual agreements to address the market situation.

Llodio, November 10, 2020. The economic uncertainty due to COVID-19 is slowing down investment-related decision-making, leading to a drop in demand in the sectors served by TUBACEX. In this context, the Company’s sales figure for the first nine months of the year stands at €389.6 million, which is 18.2% lower than that of the same period last year; and an EBITDA of €26.4 million, down 42.9%, with a 6.8% margin.

These results, determined by the global macroeconomic and health care environment, and as with results for the first half, are well below the Group’s expectations at the start of the year. To combat the current market situation impact, the Company has launched an Action Plan with a thorough adjustment of costs at all levels. This Action Plan is based on three work lines: financial, costs and commercial.

The cost adjustment line seeks cost savings of 20 – 25 million thanks to a strict adjustment plan on all levels. The measures adopted include the recently announced restructuring plan that will affect approximately 20% of the workforce, which is necessary to guarantee the Group’s profitability. The results obtained by TUBACEX in the first nine months of the year with losses of €13 million, already incorporate a major part of the cost associated with this restructuring, now at a very advanced stage and only awaiting final adjustments at Spanish plants, with an also structural component. The Company expects restructuring to be fully implemented in the short term.

The financial strengthening line seeks to ensure the Group’s liquidity and solvency. This approach, already successfully completed, has enabled a full debt restructuring, via debt diversification, maturity date extensions, likewise ensuring liquidity for the Company in the short and medium term.

Under the framework of the restructuring completed as a response to COVID-19, TUBACEX has signed loans for €60.5 million over a 5 year term with a one-year grace period, by virtue of a framework agreement with 11 financial institutions with ICO funding support. Simultaneously the company has re-negotiated short-term credit facilities of €78 million in long-term installments ranging from 2 to 5 years with funding support from ICO and CESCE. Over 43% of this sum was signed for a 5 year term.

The aim of the line focused on signing relevant multi-annual agreements is to maintain and reinforce the Group’s commercial positioning and make the most of its return to the market when this happens. This recovery would enable the execution of major multi-annual term agreements aligned with the latest deals entered into the Group despite the current market situation. According to Jesús Esmorís, TUBACEX’s CEO, “our efforts focused on the commercial field are leading to the negotiation and signing of long-term agreements with the main end users of our higher added value products, despite the complicated current market situation”.

Financial solvency

TUBACEX has an excellent financial solvency and a cash position to cover all loans with maturity dates well into 2024. In terms of liquidity, the Group’s cash position amounts to €170.5 million, in addition to undrawn credit facilities of €66.4 million. As of September 30, 2020, combined liquid assets amounted to €236.9 million, in excess of €216 million recorded on December 31, 2019.

The working capital stands at €215.0 million, up €27.8 million in relation to 2019 year-end, although this occasional temporary increase is due to different reduction rates affecting current assets and liabilities. Nevertheless, the trend for the forthcoming quarters is of a gradual reduction in their net amount, adapting to the company’s activity levels.

The net financial debt amounted to €293.7 million, with a leverage ratio at 6.2x EBITDA. Another noteworthy figure is the gross financial debt of 75% classed as long-term, as opposed to 58% at 2019 year-end. Furthermore, since TUBACEX is an integrated group that works on orders, its working capital amounts to 73.2% of the debt; therefore, the company’s structural financial debt, excluding working capital, stands at €78.8 million, compared to €66.3 million at the close of 2019.

Future outlook

As for the future, it is impossible to predict the evolution of global activity as it will be determined by the virus evolution. In light of this situation, Tubacex Group upholds its fundamental goal of not destroying the operating cash position, by keeping its operating cash flow close to zero as well as its net financial debt at levels similar to those of previous years.

“In the short term, we are aware of the fact we are facing one of the most demanding and challenging times in history. Uncertainty and high volatility on all markets will be part of our day-to-day in the forthcoming months and quarters. This is why at TUBACEX we are adapting to the new realities. We are making internal adjustments aimed at guaranteeing and protecting the Company’s profitability”, points out Jesús Esmorís, TUBACEX’s CEO.

Key financial figures of the first nine months of 2020.

About TUBACEX

TUBACEX is a multinational group with its headquarters in Alava and a global leader in the manufacture of stainless steel and high-alloyed tubular products (tubes and accessories). It also offers a wide range of services from the design of tailored solutions to installation and maintenance operations.

It has production plants in Spain, Austria, Italy, the United States, India and Thailand, as well as Saudi Arabia, Dubai, Norway, Canada and Singapore through the NTS Group, worldwide service centers and sales offices in 38 countries.

The main demand segments for the tubes manufactured by TUBACEX are the oil and gas, petrochemical, chemical and power generation industries.

TUBACEX has been listed on the Spanish Stock Market since 1970 and is part of the “IBEX SMALL CAPS” Index. www.TUBACEX.com