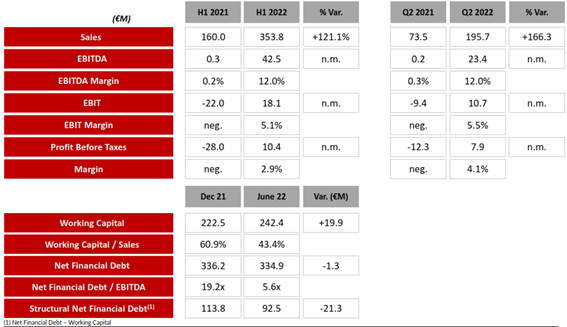

- The EBITDA stands at €42.5M, with profit before tax of €10.4M.

- Company sales in the first half of the year have amounted to €353.8M, doubling those of the first half of 2021.

- The backlog is of more than €1,500M, a historic record level, in products for gas extraction and production, fertilizers, nuclear and other highly-demanding applications.

- In spite of the increase in stocks related to special projects, the debt figure remains at levels similar to that of December.

- The energy market is currently in expansion, following seven years of continued cutbacks in investment.

- Gas and nuclear energy present very good prospects in the medium-long term following their recognition by the European Union as being green energy and essential for the energy transition.

- The greatest uncertainty comes from the complicated economic environment characterized by the high rates of inflation and the threat of a potential crisis or even stagflation.

Llodio, July 21 2022. TUBACEX has presented its results for the first half of the year to the CNMV, having consolidated its growth in an energy market in expansion. Company sales for the first half of the year have amounted to €353.8M, doubling those obtained in the same period last year, with profit before tax of €10.4M compared with a loss of €28M in the first half of 2021. The EBITDA for the second quarter has amounted to €23.4M, which is the highest quarterly EBITDA since the last quarter of 2007. The accumulated EBITDA for the year stands at €42.5M with a margin of 12%, in line with the strategic objective set in June. These results highlight the success of the TUBACEX strategy in a market environment characterized by inflationary pressure.

In recent years, the company has promoted its geographic expansion and sectoral diversification and has also reorganized its production with a product mix tailored to the profile of each of the group’s 20 plants around the world. This strategy has boosted TUBACEX’s growth and has enabled it to return to normality and profit in all of the group companies.

On the other hand, the sales strategy followed in recent years has made it possible to access different framework agreements with the leading players in the industry, enabling it to be positioned wherever its demand may be. An example of this is the agreement entered into recently with the Abu Dhabi National Oil Company (ADNOC) for a value in excess of 30,000 tons over a period of ten years for the supply of comprehensive solutions for gas extraction in the Middle East, and which involves the construction of a new plant in Abu Dhabi, the first one to manufacture OCTG in the Middle East.

This order, along with others obtained recently from Exxon, Petrobras, etc., make TUBACEX one of the world’s leading manufacturers of this product for gas. These are added to other agreements reached by the company in the past few months, which, as a whole, increases its backlog to more than €1,500M, a historic record for the company. “Our good positioning in the market has led to order intake in this first half of the year being very good in all high value-added products, such as OCTG, Umbilicals, Fertilizers, Nuclear and other highly-demanding applications, for which our special materials are required”, indicated Jesús Esmorís, CEO of TUBACEX. These products are manufactured at the group plants all over the world, with significant orders mainly in Italy, the USA, Austria or the Basque Country, although a major part will be produced at the new plant in Abu Dhabi.

The working capital amounts to €242.4M, up €19.9M on the 2021 year-end. The increase in working capital is closely related to the rise in stock levels. The increase in stocks is due partly to the higher value of the stock, as a result of the increase in the cost of raw materials and energy and the premium product mix. On the other hand, stock in progress related to special orders, mainly for Petrobas and EDF, has increased, whereby its manufacturing commenced at the end of 2021 but will be invoiced as of August. These effects will be gradually reduced in the second half of the year, which will enable both the group’s working capital and net financial debt figures to be reduced.

Sound financial structure

The net financial debt amounts to €334.9M, having been reduced by €1.3M with respect to the end of the 2012 financial year. The net financial debt over EBITDA ratio has improved significantly, going from 19.2x at the close of 2021 to 5.6x, and is expected to reach 3-4x by the end of the year. It should be emphasized that given the nature of the products offered, which are designed for specific projects, TUBACEX products are made mostly to order. As a result, the net financial debt is closely linked to the working capital, most of which is already sold. Proof of this is that the Stock figure is higher than that of net financial debt.

Prospects for the second half of the year

The past seven years of drastic cutbacks in investment, along with the current supply crisis, are leading to the general reactivation of the energy market. Furthermore, gas and nuclear power, segments that require TUBACEX’s most demanding products, are key in the medium term following the European Union’s recognition of them as essential sources of energy for the energy transition.

However, the general macroeconomic environment is uncertain, with significant increases in costs, particularly for raw materials and energy, which TUBACEX has been passing on to its customers up to now, albeit with some difficulty and lag.

In spite of the necessary caution in light of the economic situation in the coming quarters, TUBACEX confirms its forecast of achieving results in 2022 above those obtained in 2018 and 2019, thanks to the high backlog, its good positioning in an energy market in expansion and the capacity to pass on the increase in costs to the end users.

About TUBACEX

TUBACEX is a world leader in sophisticated industrial products and high value-added services for the energy and mobility sectors. With offices in Álava, TUBACEX has 20 production plants (Spain, Austria, Italy, USA, India, Thailand, Saudi Arabia, Dubai, Norway, Canada, Singapore, Guyana and Kazakhstan) on four continents, and service centers and sales offices worldwide. TUBACEX is an expert in maximum-efficiency applications for the Oil & Gas and energy generation sectors and other industrial applications. The TUBACEX commitment to emission reduction has been validated by the Science Based Targets (SBT); TUBACEX has also been listed by other reputable rating agencies, including the CDP, and the Ecovadis and S&P sustainability ratings.

TUBACEX has been listed on the Spanish Stock Market since 1970 and is part of the IBEX SMALL CAPS Index: www.TUBACEX.com