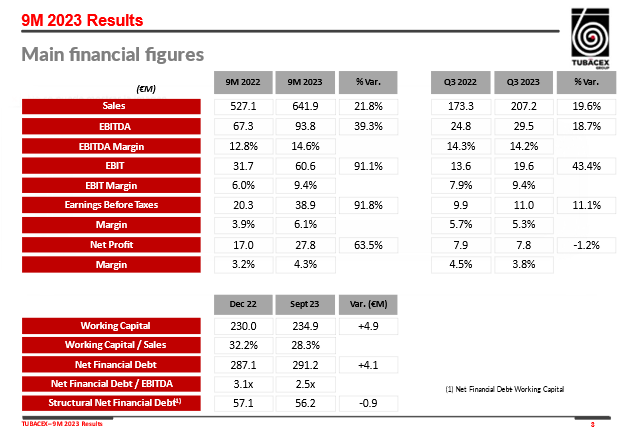

- The profit before taxes increases to 38.9 million euros, with a margin of 6.1% on sales.

- EBITDA through September reaches €93.8 million, a 39.3% increase compared to the same period last year, with an EBITDA margin of 14.6%.

- Sales in the first nine months of 2023 amounted to €641.9 million, a 21.8% increase over the same period last year. The order backlog remains at €1,630 million, confirming the positive outlook for the end of 2023, ensuring visibility for 2024, with significant growth in low-carbon products aligned with the energy transition.

- These results consolidate the company’s growth trend and strength, anticipating the achievement of the strategic objectives announced for 2025.

- All units of the group have generated positive results in a macroeconomic and geopolitical environment with serious uncertainties, highlighting the strategic commitment of the Tubacex Group.

- Tubacex will hold its Capital Markets Day on November 21, 2023, where it will update its strategic objectives.

Derio (Viscay), October 27, 2023.

Tubacex presented the results of the first nine months of 2023 to the CNMV today, surpassing those achieved throughout the past year.

During this period, the company achieved a record revenue figure and maintained an order backlog at historic highs, confirming positive expectations for the year and ensuring visibility for 2024.

Sales reached €641.9 million, a 21.8% increase over the same period last year, with total profits of €27.8 million, a 63.5% increase.

Furthermore, EBITDA through September reached €93.8 million, a 39.3% increase compared to the figure achieved in September 2022, surpassing last year’s EBITDA figure. The EBITDA margin was 14.6%.

The robust performance in order entries is notable, remaining at very high levels, allowing the backlog to be maintained at €1,630 million.

It is noteworthy that these results have been achieved in a complex and challenging macroeconomic and geopolitical environment, combined with a declining trend in commodity prices. This underscores the Tubacex Group’s commitment to sectoral diversification as well as its global presence, reinforcing its role as a key player not only in the energy transition but also in ensuring energy supply.

Jesús Esmorís, CEO of Tubacex, stated, “With the results we have presented to the CNMV, we confirm the expectations that 2023 will be a historic year in terms of results. In addition, our current order backlog increases visibility for 2024”.

Tubacex continues to strengthen its financial position with €131.3 million in cash and a liquidity position of €204.4 million. A portion of the cash generated in the initial half of the year has been employed for the acquisition of the minority stake in Saudi Arabia, the acquisition of a subsidiary in Norway, the initiation of the investment in the Abu Dhabi plant, and the payment of dividends for 2022.

The company’s cash generation demonstrates its strength, with net financial debt maintained at a level like the end of 2022, and the net financial debt-to-EBITDA ratio is at 2.5x, meeting the strategic objective and expected to continue decreasing in the last quarter.

It should be noted that Tubacex’s manufacturing strategy against orders makes net financial debt closely linked to working capital, which is mostly already sold. The stock’s very positive performance is also worth mentioning, having grown by 52.2% during the current year and, according to market consensus, it keeps presenting significant growth potential.

Energy Transition

Tubacex’s strong commitment to sustainability and the energy transition positions it as a leader in its sector. The company has received an A- sustainability rating from the prestigious organization CDP (Carbon Disclosure Project), placing it among the best in its category. Additionally, because of its commitment to supporting its customers and suppliers in decarbonization processes, it has been included in the list of supplier engagement leaders, which evaluates the results of Tubacex’s actions on climate-related issues within its supply chain.

In the realm of transitioning to sustainable energy, Tubacex continues to show great dynamism in carbon capture, utilization, and storage (CCS) projects, mainly in the United States, facilitated by federal government incentives. This is an emerging market on the international scene with significant growth prospects. In fact, Tubacex, a pioneer in its sector, has secured its first order in the Malaysian market for this business.

Additionally, the strong positioning of its Tubacoat tubular solution in the Middle East has enabled several orders in Saudi Arabia for critical applications that contribute to energy efficiency and the reduction of CO2 emissions in the refinery sector. These initiatives, along with hydrogen developments and biomass energy recovery projects, underpin the company’s position in the low-carbon technology segment.

Regarding the breakdown of sales by sector, during the first nine months of this year, 37% of Tubacex’s products were destined for the industrial sector, 25% for the gas exploration and production (E&P) sector, 17% for oil E&P, 15% for new markets, and 6% for other energy sources.

In terms of the final destinations of its sales, there is significant geographic diversification, with 42% of sales occurring in Asia and the Middle East, 33% in America, 21% in Europe, and the remaining 4% in Africa.

The company currently runs 24 factories in 14 countries and 14 service centers to meet the demands of its customers. The strong growth in demand from new markets, such as aerospace, both in commercial aviation and space exploration; the defense sector; and the hydraulic and instrumentation (H&I) segment is noteworthy. Specifically, Tubacex will supply H&I pipes for the prestigious IOCL project in India.

Likewise, in the last three months, the company has formalized several high-value orders for the fertilizer industry.

Due to its practice of entering into long-term agreements with its key clients, the CRA OCTG segment, in which Tubacex is a global reference, continues to receive investments from major operators in the Middle East, Brazil, and the Caribbean.

Specifically in Brazil, Tubacex has successfully implemented its 360º value proposition for its customer Petrobras, providing a comprehensive solution that includes product installation supervision in wells and training of platform personnel. A significant new order has also been placed in the umbilical tube segment for Turkey, as well as a commercial milestone that marked the first order with a manufacturer of floating production, storage, and offloading (FPSO) vessels for the gas sector.

As a noteworthy development in this business, a new joint venture has been established between SLB and Aker Solutions during this period. Tubacex’s close relationship with both companies offers the company a unique opportunity to strengthen its position in the offshore/subsea market.

Regarding the industrial sector, the entry of orders for high-value-added products continues at a good pace. The Midstream, LNG, and Gas Processing segments maintain a high level of activity and visibility, especially in North America and the Middle East, although some projects are being reevaluated due to increasing macroeconomic uncertainty and high interest rates.

On the other hand, the nuclear market remains dynamic, with promising prospects for the coming years. Among other factors, Tubacex enjoys a strong position with EDF as a long-term strategic partner, both for supplying equipment to new power plants and for maintenance projects in their reactor portfolio.

About Tubacex

Tubacex is a global leader in the design, manufacturing, and installation of sophisticated industrial products and high-value-added services for the energy and mobility sectors. Tubacex provides value to its customers through its global presence, with production facilities and service centers in Spain, Austria, Italy, the United States, India, Thailand, Saudi Arabia, Dubai, Norway, Canada, Brazil, Singapore, Guyana, and Kazakhstan. Its sustainability and environmental policies are endorsed by leading ESG certification bodies, including commitments to reduce emissions through Science-Based Targets (SBT), accreditation in ratings like CDP (Rating A-), and adherence to S&P sustainability standards. Tubacex has been listed on the Spanish stock exchange since 1970 as part of the Ibex Small Caps Index.