Tubacex affirms a favorable outlook for 2023 and enhances visibility for the upcoming year.

- The second quarter of 2023 marks the eighth consecutive quarter of improved results with the highest quarterly EBITDA and margin in the company’s history.

- Its premium multi-sector business model enables Tubacex to maintain a record order backlog of €1.65 billion.

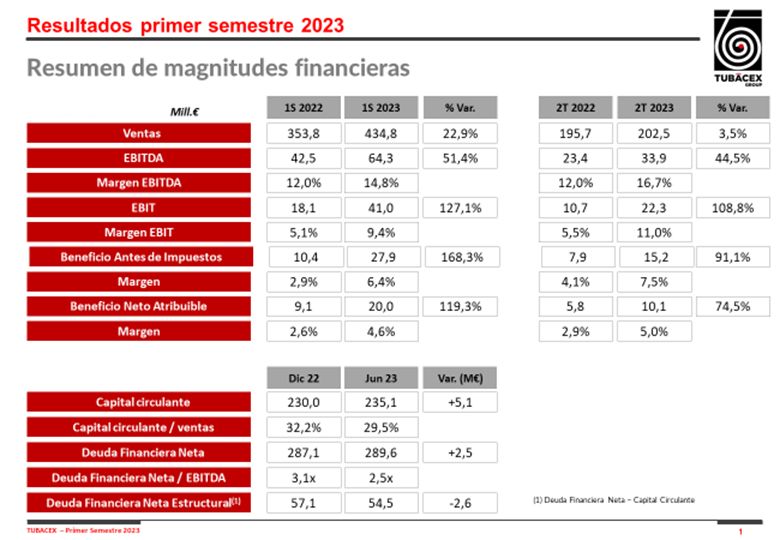

- Sales for the first half of the year reached €434.8 million, representing a 22.9% increase compared to the same period last year

- EBITDA reached €64.3 million, with a margin of 14.8%, aligning with the Group’s strategic objectives.

- The low carbon business segment shows significant growth, aligned with the energy transition, with optimistic prospects in the carbon storage and capture business.

- The strong order backlog anticipates a second semester in line with the first and increases visibility for 2024.

Bilbao, July 21, 2023 – Tubacex presented today to the CNMV (National Securities Market Commission) its results for the first half of 2023, characterized by a strong performance based on its business model and a historical order backlog.

Sales, which represent the highest semi-annual figure in Tubacex’s history, reached €434.8 million, reflecting a 22.9% increase compared to the same period last year. The accumulated EBITDA for June reached €64.3 million, with a margin of 14.8%, aligning the Group with its strategic objectives. The profit stands at €20 million, more than double that of the first half of 2022. These figures reflect the success of the positioning strategy in high-value-added products and solutions.

It is worth noting that Tubacex has achieved improved results for eight consecutive quarters, with an EBITDA of €33.9 million and a quarterly margin of 16.7%, the highest in the company’s history. The positive mix and cost optimization efforts in recent years have offset the inflationary environment and contributed to these results.

Currently, Tubacex holds a record order backlog of €1.65 billion, which, combined with the positive trends in its businesses and markets, allows for a positive outlook for the second half of 2023, expected to be in line with the first half. According to Jesús Esmorís, CEO of Tubacex, “the results for the first half confirm our expectations in terms of improved results and gross cash generation. We maintain a high order backlog that allows us to anticipate a historic year in terms of sales and EBITDA, increasing our visibility for 2024.” The company will update its strategic objectives in the second half of the year.

Working capital stands at €235.1 million, €5.1 million higher than the closing figure of 2022, in a business environment with a sales growth of 22.9%. The inventory figure for the semester increased by €30.2 million compared to the December closing, mostly due to finished high-value-added products already sold. This increase reflects the rise in raw material and energy prices, which have been transferred to the market, as well as the higher value of stock resulting from the premium product mix in production. The working capital-to-sales ratio meets the strategic objective of remaining below 30%.

It is worth mentioning that part of the cash generated during the first half of the year has been allocated to the acquisition of minority participation in Saudi Arabia, the acquisition of a stake in Norway, the start of the investment in the Abu Dhabi plant, and the payment of dividends from 2022 results. These non-recurring operations, along with the company’s capital expenditures, have resulted in a cash outflow of €30 million. Despite these payments, the company’s net financial debt has remained at a similar level to the closing of 2022. Furthermore, the net financial debt-to-EBITDA ratio has improved, decreasing to 2.5x, in line with the strategic objective, and maintaining the trend of improvement in the coming quarters. It is important to note that Tubacex’s manufacturing-to-order strategy tightly links net financial debt to working capital, which is mostly already sold.

Finally, the Group’s financial strength is noteworthy, with €146.9 million in cash and a liquidity position of €204.9 million.

Order intake during the semester has remained strong, although the macroeconomic environment and interest rate increases have caused some slowdown in sales of lower-value-added products, as well as in certain business segments in the North American market. On the other hand, the gas exploration and production sector, as well as the Asian and Middle Eastern markets, show significant sales growth for the Group, in line with strategic objectives.

In terms of business segments, sales by sector are as follows: 42% Industrial, 19% Gas E&P, 16% New Markets, 15% Oil E&P, and 8% Powergen. Geographically, sales were distributed as follows: 40% in Asia and the Middle East, 35% in America, 21% in Europe, and 4% in Africa.

Lastly, it is noteworthy the process of identifying and securing low carbon projects, with an increase in orders for the CCUS (carbon capture, utilization, and storage) business, focused on the United States, Asia, and Australia. In the same context, Tubacex has secured contracts for several projects involving the construction of biomass plants in India for electricity generation from agricultural waste, as well as participation in various initiatives for hydrogen development, all aligned with its commitment to sustainability and the energy transition.

About Tubacex

Tubacex is a global leader in the design, manufacturing, and installation of high-value-added industrial products and services for the energy and mobility sectors. It brings value to its customers through its global presence, with production plants and service centers in Spain, Austria, Italy, the United States, India, Thailand, Saudi Arabia, Dubai, Norway, Canada, Brazil, Singapore, Guyana, and Kazakhstan. Its sustainability and environmental policies are endorsed by major ESG certification bodies, such as Science Based Targets (SBT) emission reduction commitments, CDP accreditation (A- rating), and sustainability standards from S&P. Tubacex is listed on the Spanish stock exchange as part of the Ibex Small Caps Index.