- Tubacex is finalizing the launch of the new CRA OCTG finishing and threading plant in Abu Dhabi, which will commence operations at the end of 2024 to execute the macro contract. Significant additional orders are also expected this year.

- The order book stands at around €1.6 billion, at record levels, thanks to a business model based on offering premium, multi-sector solutions (high value-added) with an increasing importance of Low Carbon solutions.

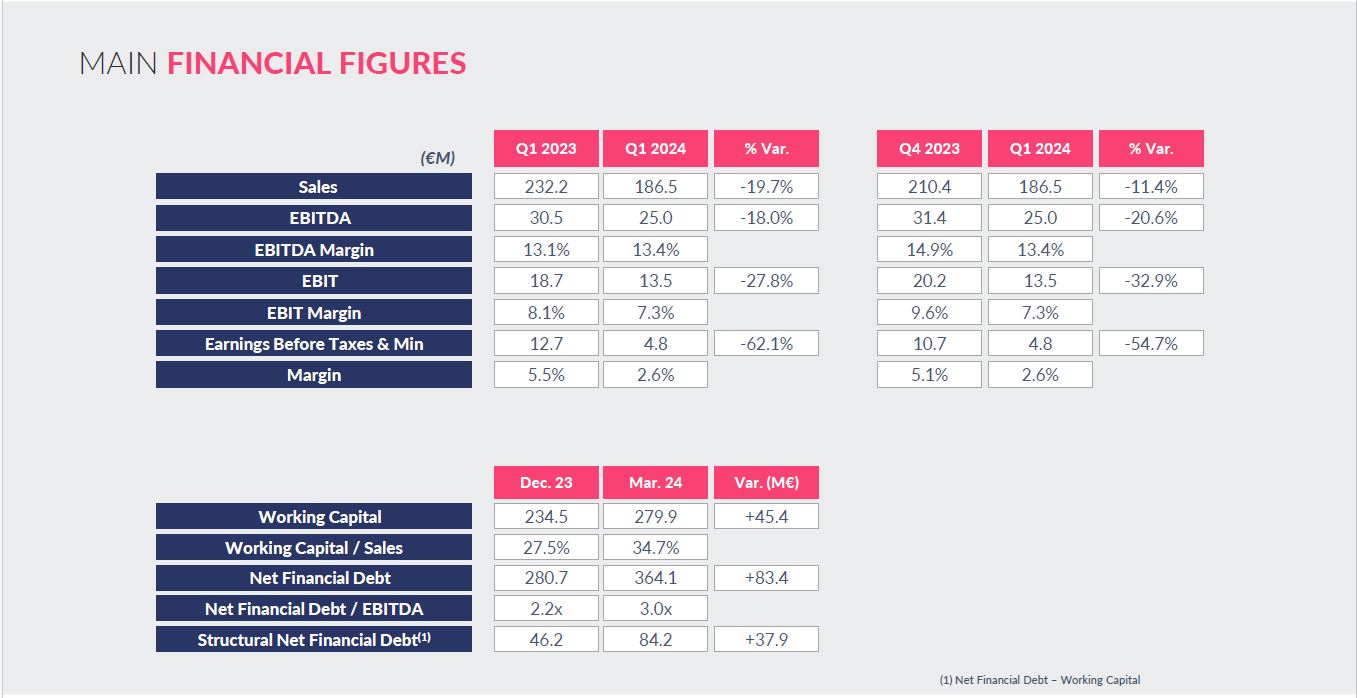

- Sales were €186.5 million, EBITDA reached €25 million, and profit before taxes and minority interests was €4.8 million.

- The company closes the first three months of the year with an EBITDA margin of 13.4%, compared to 13.1% achieved in the same period last year.

- The period ends with a liquidity position close to €190 million and a Net Financial Debt/EBITDA ratio of 3 times.

- Tubacex reaffirms its targets set under the new NT2 Strategic Plan announced last November to achieve sales between €1.2 billion and €1.4 billion and an EBITDA over €200 million by 2027.

Bilbao, April 25, 2024.

Tubacex Group has concluded the first quarter of 2024 with consolidated sales of €186.5 million, a temporary reduction compared to the same period last year, due to a declining trend in nickel prices, an increase in inventory related to projects that will be billed in upcoming quarters, and the initiation of certain Petrobras projects planned for the first half of the year now rescheduled for the second half.

As of March 31, 2024, the accumulated EBITDA reached €25 million, while the EBITDA margin was 13.4%. The company estimates that the delays from the first quarter—which have affected the entire sector—will be recovered in the second half of the year, allowing for an increase in both revenue and EBITDA, and profits. Meanwhile, the profit before taxes and minority interests at the end of the period stood at €4.8 million.

It is noteworthy that despite the complex macroeconomic and geopolitical environment, all the Group’s business units have satisfactorily contributed to the results achieved by the Group, reinforcing Tubacex’s role not only in the energy transition but also in ensuring energy supply.

Looking ahead to the end of 2024, the prospects are positive. The year is expected to be characterized by a gradual improvement in quarterly results, with a better second half in terms of EBITDA (in both results and margins), and capture levels that will allow for strong growth in 2025.

Additionally, order intake remains at very high levels, both in volume and margin. The current sales-to-order ratio, termed in Anglo-Saxon terms as “book-to-bill,” remains around 1, a sign of the company’s good health. This allows the order book to be positioned at €1.6 billion (the same levels as at the end of 2023) and ensures visibility for the business in upcoming periods.

Jesús Esmorís, CEO of Tubacex, stated, “With the results we have presented to the investment community today, the Group concludes the first quarter with high levels of profitability. We remain optimistic for the full year, in a year that will progressively improve. The current order book gives us substantial visibility for the coming quarters. Additionally, and it is important to highlight this for its future relevance to the Group, Tubacex has already received the first order under the macro contract with ADNOC, a critical milestone that marks the commencement of the project, with more significant orders expected throughout the year.”

Detailing revenue breakdown by sector, 32% of the Group’s product revenue originated from the Industrial sector, 24% from E&P gas, 19% from E&P oil, 18% from new markets, and 7% from Powergen. This diverse sales mix leverages both current and future low-emission energy sources, as well as so-called transition energies (gas and nuclear).

In terms of sales destinations, the Group maintains a broad geographical diversification of its revenue sources, with 42% of billing occurring in Asia and the Middle East (where it has substantial exposure to the gas segment, both in extraction and processing, aligned with strategic goals), 23% in America, 31% in Europe (with strong demand for complex machined products in the North Sea and long-term contracts with umbilical manufacturers), and the remaining 4% in Africa.

Financial Strength: Reinforcing Liquidity and Cash Position

Throughout the analyzed period, Tubacex has maintained its financial strength, as evidenced by the debt-to-EBITDA ratio (Net Financial Debt/EBITDA) which stands at 3 times as of the end of March. It is projected to gradually decrease in line with the objectives of the NT2 Strategic Plan 2023-2027 to position the figure below 2 times—a goal that remains after the quarterly figures. Additionally, the Group boasts a liquidity position close to €190 million.

This financial resilience is maintained even as Tubacex is constructing the new CRA OCTG tube finishing and threading plant in Abu Dhabi, part of the major $1 billion project set to commence operations at the end of this year. To date, €30.7 million has been invested in the project. Moreover, part of the cash generated in the early months of this year was allocated to strategic investments in tooling for the NTS group. These investments ensure Tubacex’s future competitive stance in the Middle East.

The net financial debt stands at €364.1 million and includes both the strategic investments and an increase of €45.4 million in working capital. This increase is linked to Tubacex’s strategy of manufacturing against order, closely tying both figures.

Positive Long-Term Trend Across All Group Units

Reviewed by Business Units, the E&P Oil&Gas (upstream) activity maintains strong and constant demand in the Middle East and Asia, primarily in OCTG, translating into very positive demand prospects at least in 2024, 2025, and 2026. In the drilling segment the order intake remains solid, mainly in the United States, the Middle East, particularly Saudi Arabia, and Northern Norway, where a record year is anticipated.

In E&P Oil&Gas (subsea), Tubacex closed 2023 with a record order intake and key strategic projects across five continents. Additionally, ongoing strategic agreements with major umbilical manufacturers are yielding excellent, structurally significant results that continue to increase market share.

In the Industrial area, the first quarter of 2024 highlights the capture of orders for refinery and petrochemical pipelines and furnaces in China. In upcoming periods, strong ongoing investments are expected to sustain high activity levels, mainly in the Middle East, significantly influenced by LNG following the investment announcements from SAUDI ARAMCO, ADNOC, and QATARGAS.

In PowerGen, noteworthy are the two orders for USC power plants in China, nuclear maintenance contracts for EDF, and reactivation in significant projects both in India (for USC power plants) and in the United States (for SMR power plants). Contracts for future EDF plants in France under the new EPR2 design are also progressing.

In Low Carbon, regarding CO2 capture and storage (CCUS), there has been a slowdown in tender activity in the United States, resulting in project execution delays in the pipeline due to authorization delays. However, billing activity in this segment has remained solid with project deliveries in Southeast Asia. In hydrogen, efforts to position the Group’s solutions have led to securing a significant order for an electrolyzer plant in Spain. Lastly, in the Fertilizer & Ammonia segment, significant tenders are expected in the second half of the year, though the Group already has significant orders in Asia.

In New Markets, the demand growth in new markets such as aerospace and defense stand out, with several new agreements; additionally, a contract has been signed to collaborate technologically in the development of the Future Air Combat System (FCAS) program. Notably, Tubacex India has successfully manufactured its first tubular solutions for the semiconductor industry.

____________________________

About Tubacex

Tubacex is a global leader in the design, manufacturing, and installation of advanced industrial products and high-value-added services for the energy and mobility sectors. Committed to innovation and excellence, its fully integrated production model spans from research and development to final product delivery and subsequent maintenance service. This integration ensures innovative technology, superior quality, and a focus on sustainability and circularity that sets industry standards. Tubacex specializes in a range of advanced materials, including Corrosion Resistant Alloys (CRA), as well as advanced machining services.

Tubacex operates production facilities and service centers in over thirty countries, delivering value to customers worldwide. Its commitment to sustainability and environmental management is validated by leading ESG certification authorities. This includes adherence to Science-Based Targets (SBT) for emission reduction, the Carbon Disclosure Project (CDP), and compliance with sustainability criteria set by S&P. www.tubacex.com

For more information, please contact:

Raquel Ruíz, IR director: rruiz@tubacex.com

Peio Garciandia, Communications Manager: pgarciandia@tubacex.com