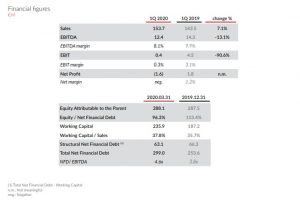

• Sales for the first quarter have amounted to €153.7M, up 7.1% on the same period last year; and the EBIDTA stands at €12.4M, with a margin of 8.1% compared to 9.9% in the first quarter of 2019.

• These results are a far cry from the company’s prospects due to the low level of activity in March as a result of the health crisis caused by the COVID-19 pandemic.

• TUBACEX’s financial structure with a cash position of €145.8M, along with long term financial transactions amounting to €115.5M, ensure the company’s liquidity and full operability in extraordinary circumstances that are conditioning global business activity.

• As for the rest of the year, the current worldwide situation is going to affect TUBACEX’s prospects for the 2020 financial year, whereby the impact on the Group’s results is still uncertain, as it will depend on the duration of the crisis and the recovery rate.

Llodio, May 14th, 2020. TUBACEX’s results for the first quarter of 2020 have been affected by the COVID-19 global pandemic. The sales figure has amounted to €153.7M, up 7.1% on the figure for 2019, and the EBITDA has reached €12.4M with a margin of 8.1% compared to 9.9% in the first quarter of 2019. These figures are a long way off TUBACEX’s prospects for the first quarter as a result of the impact of Coronavirus on business worldwide.

Therefore, the economic shutdown in countries in which TUBACEX operates has prevented normal activity at several of its plants. More specifically, those in the Basque Country, Italy and India have been affected by the shutdown measures imposed by their respective governments. At the rest of the Group’s production units, although full shutdowns have not been ordered, the necessary adoption of social distancing measures to ensure the safety of workers has also led to a reduction in activity, which was around 50% in March. The weakness of the financial markets and the fall in the price of oil and raw materials is added to this, leading to a scenario of worldwide recession.

In this context, not only has sales growth been lower than expected, but also the EBITDA margin, given the impossibility of maintaining the operating leverage ratios. However, this effect has been partially offset by the implementation of a profound costs adjustment plan at all levels, which has enabled a reasonable margin of 8.1% to be maintained.

TUBACEX’s CEO, Jesús Esmorís, confirmed that “the start of 2020 has taken us by surprise with a dramatic and absolutely unpredictable situation. The global pandemic caused by COVID-19 and its consequences, in both health and economic terms, hinders any kind of projection or outlook that we had for this year”.

Esmorís remembers that “in the midst of the oil crisis, between 2015 and 2019, the Group was committed to both organic and inorganic growth, and thanks to the efforts made from the industrial and commercial perspective, we were on the way to achieving the strategic objectives”. However, “the current worldwide crisis has shaken up our plans for this year, forcing us to focus on managing an exceptionally complicated situation which affects not only our Company, but also society as a whole”.

As has now become the norm, but even more so in the current situation, TUBACEX’s solid financial structure must be highlighted, with a high cash position in excess of €145M. Given the current macro scenario of recession and the high level of uncertainty, the Group has focused its efforts in recent weeks on protecting and strengthening the cash position. Therefore, long term financing operations have been formalized with different financial entities for a sum of €115.5M in March and April. The cash position of €145.8M for the quarter, along with the aforementioned transactions, which are a clear reflection of the support of the banking sector, ensure the company’s liquidity and full operability in extraordinary circumstances that are conditioning global business activity.

In March, the working capital figure stood at €235.9M, up €48.6M on the close of 2019, reflecting extraordinary effects that explain this increase and its subsequent direct impact on the Group’s net financial debt. On one hand, the situation caused by COVID-19 as of the first week of March has led to delays in the collection process of certain projects, which are being regulated throughout April and May. Meanwhile, the company’s overall working capital is yet to reflect the reduction in commercial and industrial activity derived from the impact of the pandemic on the global supply chain. It is likely that the working capital will be reduced throughout the year.

The net financial debt amounted to €299M, placing the Net Debt to EBIDTA ratio at 4.6x, whereby its rise with respect to the close of 2019 is solely related to the increase in working capital. According to TUBACEX’s business model, in which products are made to order, the financial debt is closely related to the working capital, which has mostly already been sold at a positive net realizable value. The working capital represents 78.9% of the debt, so the company’s structural financial debt excluding the working capital stands at €63.1M, down €3.2M on the figure at the close of 2019.

COVID-19 Measures

TUBACEX’s Board of Directors has decided to modify the distribution of profit proposal for the 2019 financial year, suspending the payment of the dividend of €0.0369 net per share. However, TUBACEX maintains its firm commitment to shareholder remuneration and, therefore, as proof of the trust in the Group’s growth project, it has implemented a parallel share buyback scheme for its subsequent amortization. The volume of funds assigned to this scheme amounts to €6M.

TUBACEX’s Board of Directors is still committed to the regular payment of shareholder dividends, so when more light is shed on the effects of the COVID-19 crisis, the Board will re-evaluate the situation in order to proceed, if appropriate, to the reestablishment of dividends.

Prospects

As for the rest of the year, there is no doubt that the current worldwide situation is going to affect TUBACEX’s outlook for 2020, placing the business in an inevitable scenario of global recession. The magnitude of the impact of this crisis on the Group’s results is still uncertain as it will depend on its duration and recovery rate towards a normal scenario. In light of this situation, the Tubacex Group has set the fundamental goal of not destroying the operating cash flow, by maintaining an operating cash flow close to zero.

Key financial figures for the first quarter of 2020

About TUBACEX

TUBACEX is a multinational group with its headquarters in Alava and a global leader in the manufacture of stainless steel and high-alloyed tubular products (tubes and accessories). It also offers a wide range of services from the design of tailored solutions to installation and maintenance operations.

It has production plants in Spain, Austria, Italy, the United States, India and Thailand, as well as Saudi Arabia, Dubai and Norway through the NTS Group, worldwide service centers and sales offices in 38 countries.

The main demand segments for the tubes manufactured by TUBACEX are the oil and gas, petrochemical, chemical and power generation industries.

TUBACEX has been listed on the Spanish Stock Market since 1970 and is part of the “IBEX SMALL CAPS” Index. www.TUBACEX.com